The decisions that English-medium international independent K-12 schools make when selecting and purchasing new resources and supplies have been investigated for a new ISC Research report. Schools including American schools overseas, International Baccalaureate World Schools and other international schools that offer learning in the language of English for children aged between 3 and 18 across 35 countries were researched. The aim was to understand the resources and services these schools require, and how and why they make the choices they do.

Although many education suppliers deliver some level of international sales, many do not realize the extent of the international independent schools market and the business opportunities it offers.

Teachers, school leaders and procurement managers responded to quantitative research and shared advice for education suppliers and consultants. The report includes insights into common international school procedures, and external factors that influence purchasing decisions and processes. It provides an important guide for education suppliers into the world’s international schools market, which differs significantly from the domestic K-12 sector, helping them to develop a strategic approach and understand key channels and trends that are relevant and solutions-focused.

Why suppliers value the international independent schools market

Although many education suppliers deliver some level of international sales, many do not realize the extent of the international independent schools market and the business opportunities it offers. In the past ten years, the global English-medium international independent K-12 schools sector has increased 62% from 7,660 to 12,459 schools now serving the needs of 5.7 million students. 17% of this market is US oriented schools, and 69% follow an international ethos and curricula such as the International Baccalaureate. Thousands of US educators are teachers and leaders within this sector, making the decisions on the school and classroom resources and services their international school requires.

In the past ten years, the global English-medium international independent K-12 schools sector has increased 62% from 7,660 to 12,459 schools now serving the needs of 5.7 million students.

The market is competitive; international schools not only offer an alternative education solution to domestic state and independent schools but, in many cities, compete against each other. As a result, education standards and resources are considered important value propositions for international school admissions.

External factors impacting choice

Supplying beyond borders can create logistics challenges, but may realise significant revenue benefits for some education suppliers. In-country resources and providers are very limited in certain countries and, to remain competitive, many international schools seek out the best in global education resources, relying heavily on online and digital teaching and learning resources, as well as digital solutions for school administration.

Due to COVID limitations and carbon footprint, more international schools are accessing physical products, when it is possible, within their host country. However, access to relevant resources varies significantly from one country to another and most schools have to reach out to international suppliers for certain goods and services.

The report highlights some of the factors influencing supply to different countries, along with shifting priorities for international schools. COVID-19, for example, has acted as a catalyst to increased priority for tech products and services, and wellbeing solutions for many international schools. This is influencing budget allocation and selection processes for resources.

Trusted channels for decision-making

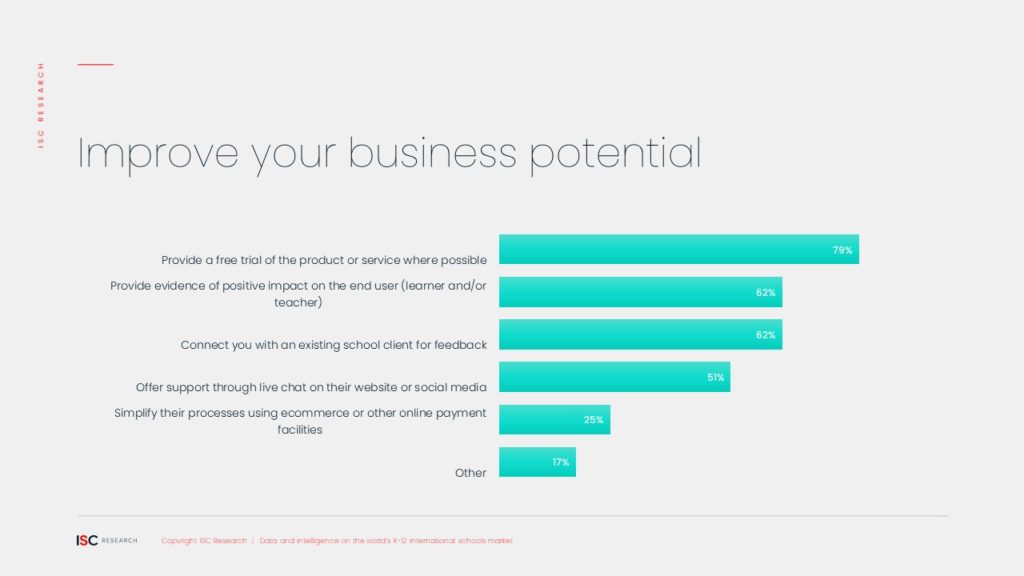

Our research for the report shows that international schools are becoming more discerning in their selection of new products and services. Most schools want time and opportunity to put a potential product or resource to the test before making a purchase. 80% of respondents said they are more likely to make a purchase after a free trial, and one school leader reflected the comments of several when they said, “If a supplier doesn’t provide samples of their product, I immediately disqualify them.”

Many schools said the feedback of peers is very important to them when selecting new brands. 62% of respondents said they want the chance to talk directly to existing customers about a new product and to see evidence of impact on current end users before making a decision. Brand reputation from awards and media recognition is also valued.

Schools prefer to get to know new brands and representatives through word of mouth recommendations and through their own research via search engines, as well as meeting new suppliers at exhibitions and conferences, and connecting through relationship marketing, rather than being targeted by generic sales approaches and unknown individuals. This requires suppliers to commit to a long-term strategic plan for successful international development.

62% of respondents said they want the chance to talk directly to existing customers about a new product and to see evidence of impact on current end users before making a decision.

The report highlights the typical purchasing cycle of international schools. For international schools located in the Northern Hemisphere, most investment decisions for the following academic year are finalised between February and April. 65% of respondents in the research said their school follows this process. ‘Mop-up’ budget purchases typically occur for these schools in May.

Why brands lose business

Five common mistakes that brands make when working with international schools are listed in the report. These are the main reasons why most schools choose not to work with a particular supplier.

Mistakes include a lack of market research and analysis resulting in a supplier not remaining fully aware of the cultural, political and legal requirements of a country which can directly affect the needs of a school, and inadequate training and support. “Many schools complain they feel isolated by the supplier once a purchase has been made,” says the report, so suppliers need to incorporate robust implementation guidance, training and support needs into a sale. Regional or in-country support can influence a school’s selection decision too, as can access to 24-hour technical support for edtech products and resources.

During our research, respondents were emphatic about the marketing and sales processes of potential suppliers that do not work. Generic emails and spamming are damaging to a brand reputation, as is poor research of the school and its needs. Marketing a resource or service without a price guide is considered frustrating by many schools.

“This highlights the need for a strategic approach, using multiple routes to engagement, and relying on a clearly defined segmentation of the market and audiences,” says the report.

The Purchasing Plans white paper is free from ISC Research.